Business Insurance in and around Green Bay

Calling all small business owners of Green Bay!

Helping insure businesses can be the neighborly thing to do

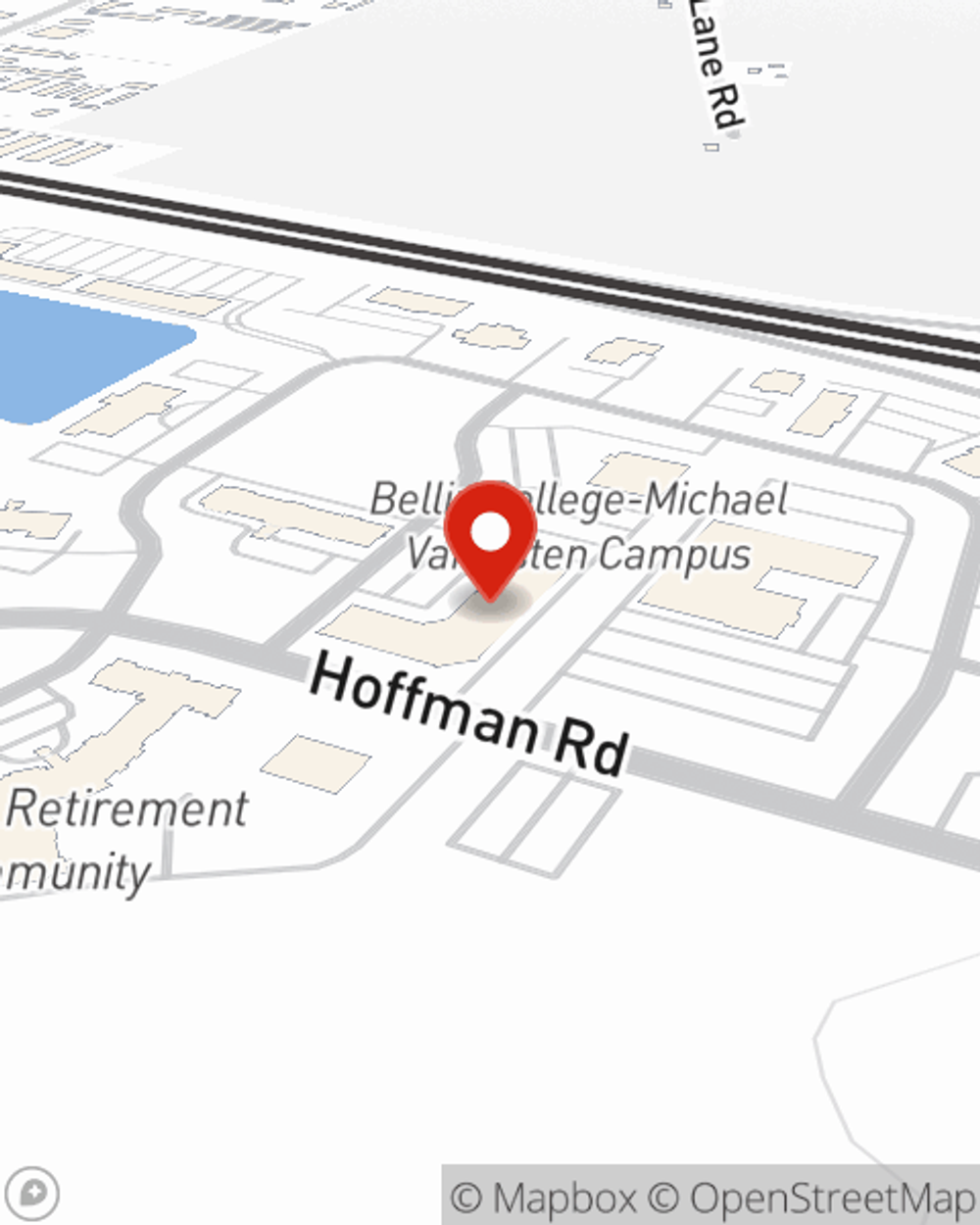

- Green Bay

- De Pere

- Bellevue

- Howard

- Suamico

- Denmark

- Wisconsin

- Wrightstown

- Ledgeview

- Ashwaubenon

- Hobart

- Allouez

- Appleton

- Door County

- Milwaukee

- Madison

- E De Pere

- Fort Meyers

- Naples

- West DePere

- East De Pere

Help Protect Your Business With State Farm.

Preparation is key for when the unexpected happens on your business's property like a customer hurting themselves.

Calling all small business owners of Green Bay!

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like worker's compensation for your employees or a surety or fidelity bond, that can be designed to develop a personalized policy to fit your small business's needs. And when the unexpected does occur, agent John Allen can also help you file your claim.

Don’t let fears about your business keep you up at night! Call or email State Farm agent John Allen today, and find out the advantages of State Farm small business insurance.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

John Allen

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.